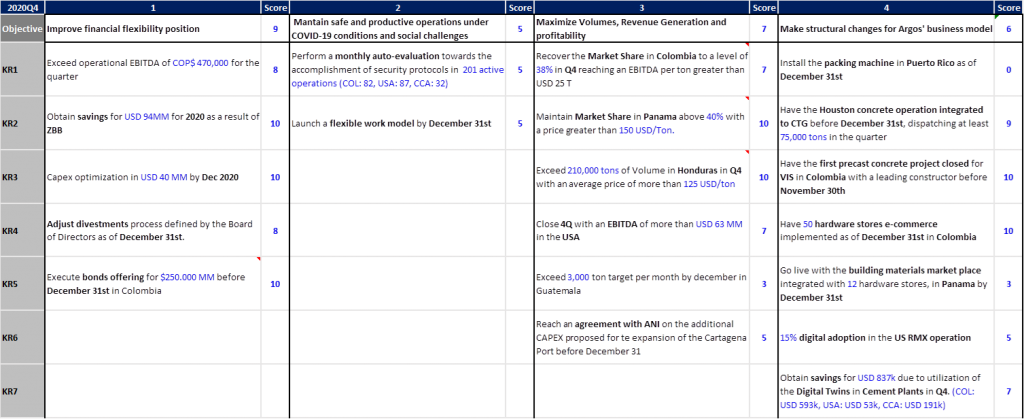

O1: Improve the financial flexibility position

KR1: Exceed operational EBITDA of COP$ 470,000 for the quarter

Grade: 8

Comments:

KR2: Obtain savings for USD 94MM for 2020 as a result of ZBB

Grade: 10

Comments: Captured saving in period April to December is USD$115.2M, including labor cost. This amount is higher than the estimated savings for the same period of time, which is USD$ 94M. Captured savings by countries, including corporate areas:

- Colombia: $51.6

- USA: $50.3

- Panamá: $6.7

- Honduras: $4.9

- Puerto Rico: $1.7.

- Excluding the exchange rate effect in countries in which a currency different to dollar is managed, savings would be USD$90.2M.

KR3: Capex optimization in USD 40 MM by Dec 2020

Grade: 10

Comments: from April 1st to December 31st the CAPEX savings results are USD 39.7M, CCA: USD 6.28M, USA: USD 9.35M, COL: USD 12.05M, Argos White USD 327k, Argos Agregados USD 1.73M, Strategic USD 10.0M, Corporate USD 56k.

KR4: Adjust divestments process defined by the Board of Directors as of December 31st.

Grade: 8

Comments: Process adjusted, Information Package sent and NBOs received as per scheduled.

KR5: Execute bonds offering for $250.000 MM before December 31st in Colombia

Grade: 10

Comments: The bond issuance was successfully completed on November 25. With a Demand of 362,740 billion COP, that is, 1.81 times the amount initially offered. A 4.25-year series was issued at the CPI + 2.24%. Amount placed 250,000 million.

O2: Mantain safe and productive operations under COVID-19 conditions and social challenges.

KR1: Perform a monthly auto-evaluation towards the accomplishment of security protocols in 201 active operations (COL: 82, USA: 87, CCA: 32)

Grade: 5

Comments:

- COL (3): In Colombia we have perform a total of 82 auto-evaluations. 52 in October and 30 in November in our operations. We have worked on 242 action plans opens from which 191 have been closed.

- CCA (10): In the Caribbean we have perform a total of 102 self-assessment: 34 in October, 34 in November and 34 in December in our operations. We have worked on 250 action plans opens from which 250 have been closed.

KR2: Launch a flexible work model by December 31st

Grade: 5

Comments: We have defined the following components within the flexible work strategy with scope for Colombia: work cell conformation, SOP telework, hybrid work plan, identification of alternatives for the best use of spaces, Change management plan, booking tool for office workspaces, alliances with third-party suppliers for the acquisition of equipment to work from home. In the coming months we plan to implement different initiatives to ensure a successful gradual and voluntary return to the administrative office facilities in Colombia.

O3: Maximize Volumes, Revenue Generation and profitability

KR1: Recover the Market Share in Colombia to a level of 38% in Q4 reaching an EBITDA per ton greater than USD 25 T

Grade: 7

Comments: 35% market share in November and EBITDA reached 86.967 COP/ton or 25 USD/ton in 2020.

KR2: Maintain Market Share in Panama above 40% with a price greater than 150 USD/Ton.

Grade: 10

Comments: The gray cement market share in Q4 was 42% (41.8%). The average FOB price was 152.89 USD/ton.

KR3: Exceed 210,000 tons of Volume in Honduras in Q4 with an average price of more than 125 USD/ton

Grade: 10

Comments: 231,992 tons sold in Q4 with an average price for local sales of 126.18 USD/ton.

KR4: Close 4Q with an EBITDA of more than USD 63 MM in the USA

Grade: 7

Comments:

KR5: Exceed 3,000 ton target per month by December in Guatemala

Grade: 4

Comments: Sales were 824 tons in October, 1134 tons in November and 751 tons in December. There were significant logistical disruptions at the border crossing due to the hurricanes that affected Honduras and Guatemala in November, traffic began to normalize at the end of the first week of December and our clients ceased operations between December 20 and January 4 . Better market dynamics are projected in Q1 2021 in which we expect to reach 3,000 tons of cement per month in a combination of bulk and bagged.

KR6: Reach an agreement with ANI on the additional CAPEX proposed for te expansion of the Cartagena Port before December 31

Grade: 5

Comments: A definitive agreement with the entity has not yet been reached, we continue in the process of structuring and negotiating a proposal.

O4: Make structural changes for Argos’ business model

KR1: Install the packing machine in Puerto Rico as of December 31st

Grade: 0

Comments: The packing machine equipment arrived at the plant. The date of the first bag of cement is projected for March 13. The delay is due to 2 reasons. The first is equipment supplier delay in their manufacturing operation because of COVID-19, the absence of containers due to port saturation in Europe and the external technicians availability during the Christmas season. The second reason is the decision to postpone the scheduled stop of the packing machine in order to avoid a shortage of cement supply in the operation. The country had a sustained demand and changes in the trading supply in recent months that made it necessary to consume cement and clinker inventories. Postponing the stop gives the necessary time to recover the necessary inventory level with trading imports.

KR2: Have the Houston concrete operation integrated to CTG before December 31st, dispatching at least 75,000 tons in the quarter

Grade: 9

Comments: The total tonnage in 2020 was 67,265 tons. The shipments were V01: 14,000 tons (shared with Puerto Rico), V03: 11,000 tons (shared with Puerto Rico), V04: 21,068 tons, V05: 21,197. Shipments had to be shared with Puerto Rico to avoid inventory breakage in this operation.

KR3: Have the first precast concrete project closed for VIS in Colombia with a leading constructor before November 30th

Grade: 10

Comments: Project closed with Constructora Bolivar. Lunaria Housing project in Tocancipá, 3 building towers with 72 apartments .

KR4: Have 50 hardware stores e-commerce implemented as of December 31st in Colombia

Grade: 10

Comments: 52 hardware stores e-commerce implemented and 100% certified users in digital training (Argos sellers and clients). Detail by Colombian zone: 14 center, 10 northwest, 17 north and 11 southwest.

KR5: Go live with the building materials market place integrated with 12 hardware stores, in Panama by December 31st

Grade: 3

Comments: 12 hardware stores were approached to present the business model out of which 7 showed their interest in being part of the market place and the others are pending for more details . The information of 3,200 SKUs of the hardware stores portfolio for the market place were collected. Despite the great challenge of the project’s legal framework to be able to sell to the end user, it was possible to find a scheme that allows us to do it based on models such as restaurant delivery applications

KR6: 15% digital adoption in the US RMX operation

Grade: 5

Comments: Digital adoption at the end of December: 7.48%. 1,984 digital orders out of a total of 26,525 orders. 677 companies, 1,153 registered users. Adoption by division from highest to lowest: 23% Houston, 12% Atlanta, 12% Dallas, 7% Tampa, 7% Raleigh Durham, 6% Orlando, 5% Sarasota Ft Myers Di, 4% Jacksonville, 3% Gainesville, 3% Macon, 3% Charlotte, 3% Columbus, 2% Piedmont (PDT).

KR7: Obtain savings for USD 837k due to utilization of the Digital Twins in Cement Plants in Q4. (COL: USD 593k, USA: USD 53k, CCA: USD 191k)

Grade: 7

Comments: Captured savings from costs reduction during Q4 in the plants where Digital Twins are being actively used in closed loop where estimated at USD 551k (COL: USD 493k, CCA: USD 58k, USA: USD 0). The plants currently capturing savings are: Cartagena, Rioclaro, Sogamoso, Yumbo and Dominican Republic. The plants expected to provide additional savings in Q1 2021 are: Harleyville, Martinsburg, Panamá and Piedras Azules.